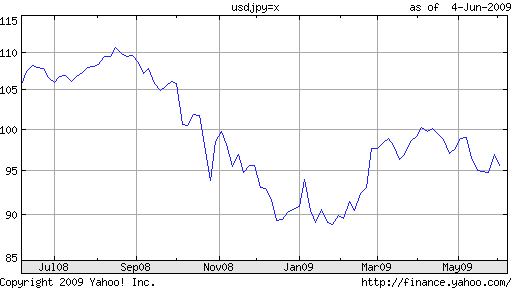

The only thing predictable about currencies these days is that they will remain unpredictable. Forgive me for speaking in cliches, but when you consider that the last twelve months have seen both record rises and record falls, I think a cliche might be justified in this case. We’ve seen the Dollar soar, only to collapse again. On the other side, we’ve seen the bottom fall out from emerging market currencies, before rising 20-30% in a matter of weeks.

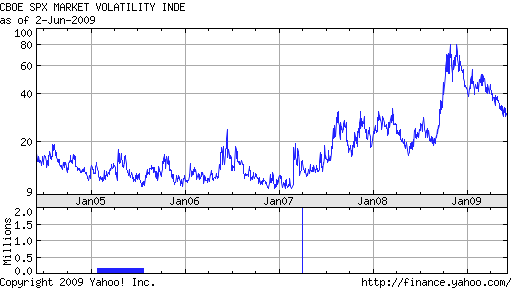

Volatility levels have certainly declined (see Chart below) from the record highs of October 2008, when Lehman Brothers collapsed. At the same time, the oft-cited VIX index remains well above its average over the last decade. This suggests that while investors may have been lulled into a relative sense of security, serious doubts remain.

If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.

If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.

Jim Rogers, a famous and perennially outspoken investor, is now sounding alarm bells over the possibility of “meltdown” in currency markets, due to inflation and currency debasement that he views as an inherent byproduct of quantitative easing and deficit spending.

Most of the attention is being focused on the US, whose stimulus and monetary programs are probably larger than all other economies in the world, combined. Offers one analyst, “We keep very low U.S. Dollar exposures because we think a further devaluation of the greenback is imminent, and we see a structural weakness for at least a number of years.” Meanwhile, there is speculation that the US could soon receive a ratings downgrade, following a similar threat by S&P directed towards Britain. But this remains highly unlikely.

The problem that Rogers (and all other investors who are worried about currency debasement) faces is how to construct a viable strategy to protect yourself and/or exploit such an outcome. Rogers himself has admitted, “At the moment I have virtually no hedges…I’m trying to figure out what to do there.” The difficulty can be found in the inherent nature of currencies, whose values are derived relative to other currencies. While you can short the entire stock market or the entire bond market (via market indexes), you can’t short all currencies simultaneously- at least not yet.

Instead, you can pick one currency or a basket of currencies, that you believed is best protected from currency collapse and buy it against threatened currencies. But how do you deal with an environment when all currencies appears equally questionable- when all governments all loosening monetary policy and risking inflation? Really, the only answer is to invest in commodities that you think represent good stores of value, such as oil or gold, or the currencies that benefit when prices of such commodities are high. Naturally, the relationship between commodities and currencies is not cut-and-dried, and if the currency system were indeed beset by meltdown, it’s not clear to me that commodities would hold their value. But that’s fodder for another post…

For most of this year we have focused on the ‘once mighty greenback’ and its weakness issues and specifically the reasons for that. Despite this, the

For most of this year we have focused on the ‘once mighty greenback’ and its weakness issues and specifically the reasons for that. Despite this, the If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.

If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.